Traditional financial systems are changing. It has become very important for how people and businesses keep track of their money. The world we live in today is shaped by three models that show different stages of financial innovation: TradFi, DeFi, and CeFi.

Every system works on its own set of rules and has its own pros and cons. They share the same goal: to make financial transactions easier to access, more open, and more efficient. To make smart investment decisions and deal with modern finance, you need to know the differences between them.

As digital transformation picks up speed, these financial ecosystems are changing how money moves, grows, and interacts across borders. Traditional finance is the base, centralized finance connects old structures to the digital world, and decentralized finance is about new ideas and financial freedom.

In this blog, we will examine each financial ecosystem, find their similarities and differences, and show how to integrate them into your business. Let’s start with the fundamentals of TradFi!

What Is TradFi?

TradFi, which stands for “traditional finance,” is the name for the traditional banking and financial system run by centralized groups like banks, governments, and financial intermediaries.

It takes people watching, rules, and trust to move and store money. TradFi includes credit cards, stock markets, and savings accounts. People who use TradFi depend on middlemen to check transactions, make loans, and keep their money safe.

This structure makes people feel safe, but the many levels of control make things more expensive and take longer. Users often have trouble accessing things, and cross-border transfers can take several business days.

TradFi is still important for keeping the world stable, even though it makes it harder for people who don’t have bank accounts to get financial services. In short, the system is built on rules and control, not openness. It is ready for new ideas because it is reliable, but it is not fast or open to everyone.

How Does TradFi Work?

Centralized authority is what makes traditional finance work. Banks and regulatory agencies keep records, enforce rules, and handle transactions. The system depends on following auditing standards and government rules to keep users safe.

TradFi institutions usually act as middlemen and help people get to capital. Some of the most important things about TradFi are:

- Only banks or other authorized groups can control all financial transactions.

- Governments use laws to set strict rules to keep people safe and stop fraud.

- The physical and digital hybrid combines digital interfaces with in-person banking. It is often slower than blockchain-based options, though.

TradFi is reliable, but it doesn’t include everyone or move quickly. When you make a payment across borders, you often have to pay a lot of fees, and it can take days for the transaction to go through.

It is very important for traditional markets because it is the most stable thing during a crisis. Modern banks still use centralized recordkeeping, but they are now adding some blockchain tools to make things go faster.

What Is DeFi?

DeFi, or decentralized finance, is a blockchain-based ecosystem that gets rid of middlemen. Instead of banks or brokers, DeFi uses smart contracts, which are automated programs that make transactions clear on public blockchains like Ethereum.

People with an internet connection can use DeFi to trade, borrow, and lend money without having to go through a third party. It gives people financial freedom and access to the world by letting them manage their assets right from their wallets. Each user is their own custodian, which means they have both power and responsibility.

DeFi is a short way of saying freedom, honesty, and openness. Users are in charge of their money, and transactions happen automatically without the need for people to be involved. It encourages new ideas, which is how yield farming, liquidity pools, and decentralized exchanges came to be.

How Does DeFi Work?

Decentralized finance is based on smart contracts, which automate all financial transactions. When these contracts are coded into blockchain networks, they run on their own.

Once they are deployed, they can’t be changed without everyone’s agreement. They run on their own. Instead of relying on a central source of trust, this system uses open code.

The main benefits of DeFi are:

- The blockchain’s public record of every transaction encourages people to be responsible.

- Anyone with internet access can join without the permission of central authorities.

- Loans and payments are made right away, with no delays or middlemen.

- Open-source protocols speed up progress by encouraging developers to build on top of existing systems.

DeFi does, however, have to deal with problems like returns that change a lot, hard-to-use interfaces, and smart contract bugs. Security is still very important, which shows how important audits and training for users are. The ecosystem is still growing, thanks to decentralized insurance, synthetic assets, and algorithmic stablecoins.

What Is CeFi?

CeFi, which stands for centralized finance, is a mix of TradFi and DeFi. Centralized organizations in CeFi are in charge of digital assets and handle compliance, security, and transactions.

Custodial wallets and cryptocurrency exchanges are two examples of platforms that use this model. They let users enjoy digital finance with the peace of mind that experts are in charge.

In CeFi, users give their cryptocurrency to businesses that take care of it and make sure it is legal. In DeFi, users do not. This hybrid system fills the gap between traditional and decentralized systems by offering strong customer support and easy-to-use interfaces.

CeFi makes it easier for more people to use cryptocurrencies by giving people who don’t know much about blockchain technology easy ways to get started. It strikes a good balance between structure and new ideas.

CeFi is great for people who want help and convenience instead of complete freedom. In order to provide flexible investment tools, many major exchanges and financial service providers now combine CeFi operations with DeFi integrations.

How Does CeFi Work?

Company-managed systems that run centralized finance bring digital assets into regulated environments. People put their cryptocurrency in the hands of a trustworthy middleman who handles transactions and makes sure that local laws are followed. These platforms often connect old and new financial models by handling both fiat and cryptocurrency.

Some of the main features of CeFi are:

- Interfaces that are easier to use for newcomers to digital finance.

- Following the rules set by financial authorities builds trust and legal certainty.

- Makes it easier to process fiat-to-crypto conversions quickly.

- Custodial protection means that central organizations are responsible for the security and insurance of user assets.

CeFi is safer and easier to use, but it takes away some of DeFi’s freedom. DeFi vs CeFi shows in many ways the trade-off between user control and institutional safety.

CeFi is also forming more partnerships with traditional banks to meet international regulatory standards. Understanding these differences helps users make better investment decisions that fit with how much risk they are willing to take.

What Are the Main Differences Between TradFi, CeFi, and DeFi?

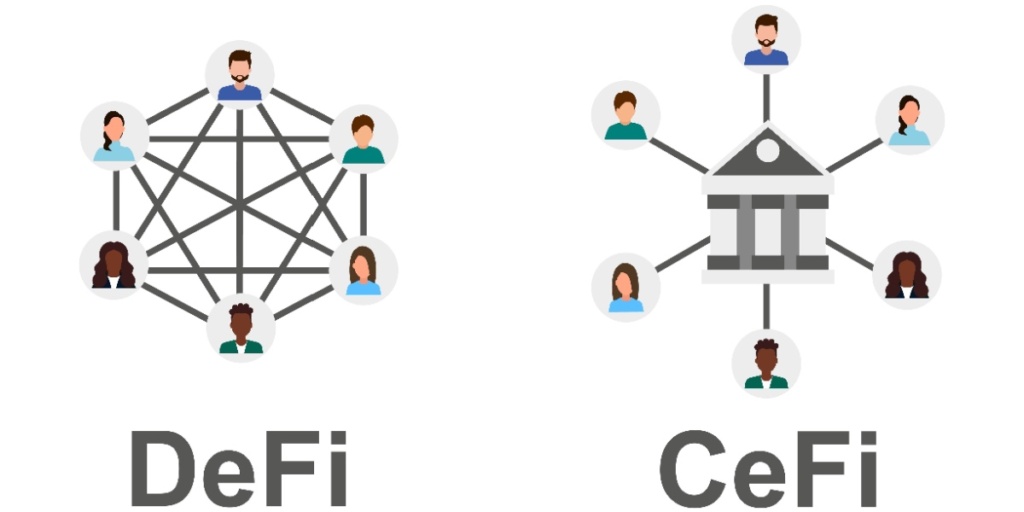

TradFi, CeFi, and DeFi are very different from each other in terms of control, transparency, and rules. Each framework has its own mix of trust, accessibility, and independence.

- Traditional finance works through banks, governments, and big financial institutions that keep user money safe and manage it. It is heavily regulated to protect consumers, but this often leads to problems like slow transactions and high fees.

- CeFi is a mix of TradFi‘s stability and blockchain’s technological progress. Companies or exchanges take care of user assets and make sure they follow the rules. They also offer faster, global transactions and services that are easy to use.

- DeFi, or decentralized finance, is completely digital and runs on blockchain protocols without any middlemen. Smart contracts do everything, which gives users full control over their assets and lets them interact with each other directly.

TradFi protects investors by making sure they follow the rules, CeFi helps people come up with new ideas, and DeFi gives people the freedom and openness they need. The right amount of risk and control depends on how much an individual or organization is willing to take on.

What Are the Main Similarities Between CeFi, TradFi, and DeFi?

TradFi, CeFi, and DeFi all have different structures and philosophies, but they all have goals that fit with the overall evolution of finance. All three want to make it easier for people to get their money, build trust with users, and get more people involved around the world.

Some important things they have in common are:

- Financial accessibility: Each model tries to help people move, invest, and manage their money safely across borders.

- Security and trust: TradFi, DeFi, and CeFi all try to keep users safe from fraud and instability, either through the law, technology, or compliance.

- New ideas in services: All models offer options for lending, borrowing, and investing, but they do so in different ways.

- Regulatory adaptation: As compliance needs change, each system grows to meet them while also making it easier for more people to get access to money.

These systems together show how financial modernization has progressed. Their coexistence fosters collaboration and propels global innovation. Businesses that use more than one model can be efficient, scalable, and trustworthy all at the same time.

When it comes to blockchain finance and TradFi, Jeton is your reliable digital partner. You can benefit from cross-border efficiency, working with all currencies including cryptocurrencies, and 50+ payment options across Europe with Jeton.

TradFi vs. CeFi vs. DeFi: What Do They Offer?

Each system offers a unique set of advantages based on the needs of the user. You get dependability with TradFi, convenience with CeFi, and power and freedom with DeFi.

The core of the economy is TradFi. Its foundations are stable institutions, people watching, and rules. Users benefit from structured services like insurance, loans, and savings, but the model is less accessible and slower.

With its user-friendly tools and security oversight, centralized finance (CeFi) simplifies the management of digital assets. Platforms facilitate users’ entry into the digital economy by enabling them to conduct both fiat and cryptocurrency transactions. CeFi protects you from the law while providing prompt service and expert assistance.

Decentralized finance (DeFi) uses blockchain protocols to automate and increase accessibility to finance. By eliminating the middleman and granting users round-the-clock access to their money, it empowers users. People from all over the world can participate in DeFi without requiring institutional approval because it is transparent, open, and borderless.

TradFi remains the most trusted component of global financial systems, while the relationship between DeFi and CeFi demonstrates the harmony between independence and supervision. Together, they can create a future where innovation and security coexist.

How Can TradFi, DeFi, and CeFi Work Together?

These systems can cooperate to form a comprehensive financial ecosystem rather than competing with one another. We have legal frameworks, rules, and structure thanks to traditional finance.

New technologies and complete transparency are brought about by decentralized finance. Together, these models create a hybrid structure that facilitates and improves efficiency.

DeFi smart contracts, for instance, can be used by banks to expedite settlements, while CeFi platforms handle customer support and regulatory compliance. This integration improves liquidity, enables instantaneous payments, and lowers the cost of cross-border transactions.

As more people collaborate, we may see networks that support all of them, such as CeFi platforms, DeFi protocols, and regulated banks, all of which operate seamlessly together. Users would benefit from the best of both worlds thanks to this cohesive ecosystem, which would balance innovation and safety.

How Do You Integrate TradFi, DeFi, and CeFi into Your Business?

Using these models in a business requires a strategic approach that prioritizes efficiency, compliance, and balance. The objective is to figure out how to combine the inventiveness of decentralized finance, the flexibility of centralized finance, and the stability of traditional finance.

TradFi ensures that everyone abides by the rules and has mutual trust. CeFi offers scalable digital payment systems, while DeFi automates processes with smart contracts, reducing human error and operating expenses.

For example, a company may use CeFi platforms to manage daily transactions, TradFi banks to hold cash on hand, and DeFi protocols to automatically settle payments. This approach simultaneously provides you with speed, transparency, and compliance.

Businesses can begin by identifying their top priorities, which may include risk management, business expansion, or improving customer outreach. By combining these models, businesses can reach clients worldwide and generate revenue in a variety of ways.

If businesses prepare ahead of time and collaborate with the appropriate partners, they can use both conventional and blockchain-based systems safely. In a world where money is increasingly digital, this strengthens their resilience.

Ultimately, the goal of financial integration is to bring models together rather than to switch between them. The collaboration of TradFi, CeFi, and DeFi will define the next stage of global finance. This will guarantee its accessibility to businesses and consumers, its constant evolution, and its long-term stability.

Wrapping Up

Whether you lean toward the stability of TradFi, the innovation of DeFi, or the balance offered by CeFi, one principle remains the same: you benefit the most when you stay in control of your money. And that’s exactly where Jeton comes in.

With Jeton Wallet, you get a secure, streamlined space to add, send, store, convert, and manage funds across borders—without the usual complexity of traditional systems.

Prefer card payments? The Jeton Card allows you to transact globally with confidence, supporting contactless payments, instant card freezing, spending limits, and smooth online or in-store purchases.

No matter which financial ecosystem you explore, TradFi stability, DeFi autonomy, or CeFi convenience, Jeton makes it easier to adapt, grow, and move your money with freedom. This is modern finance in one place… or as Jeton puts it: “one app for all needs.”

Take your next financial step with confidence:

- Get Jeton Wallet and unify all your payments in one secure space.

- Order your Jeton Card and enjoy seamless worldwide spending.

- Download the Jeton App today via the App Store or Google Play and experience digital finance across Europe.

Your financial world is evolving—Jeton helps you move with it. Sign up today!