Like right out of a science fiction movie, everybody initially was quite skeptical, even ridiculing the news about a virus breakout in the Chinese city of Wuhan that was spreading like wildfire and was relatively fatal. The rest followed a parallel plot indeed: the whole world sinking into a mass hysteria of death, confused leaders not knowing where to go, a global hike-up of the value of otherwise hardly noticeable material and an eventual total knockdown.

Covid 19 got its name from the date it was first identified linked at the end of the abbreviation of the family of virus, coronavirus that is, it belongs to and actually it gave a whole new meaning to the concept of pandemic which was previously occupied by “the black death”, or bubonic plague for ages. Despite far more fatal viral diseases broke out through the last century and recent years, it was Covid 19 that deserved its title of pandemic as its ability to escape containment and fatality rate has been “crafty” enough to plunge the world into a pit where making a contact with another person looked like daring to go against a zombie.

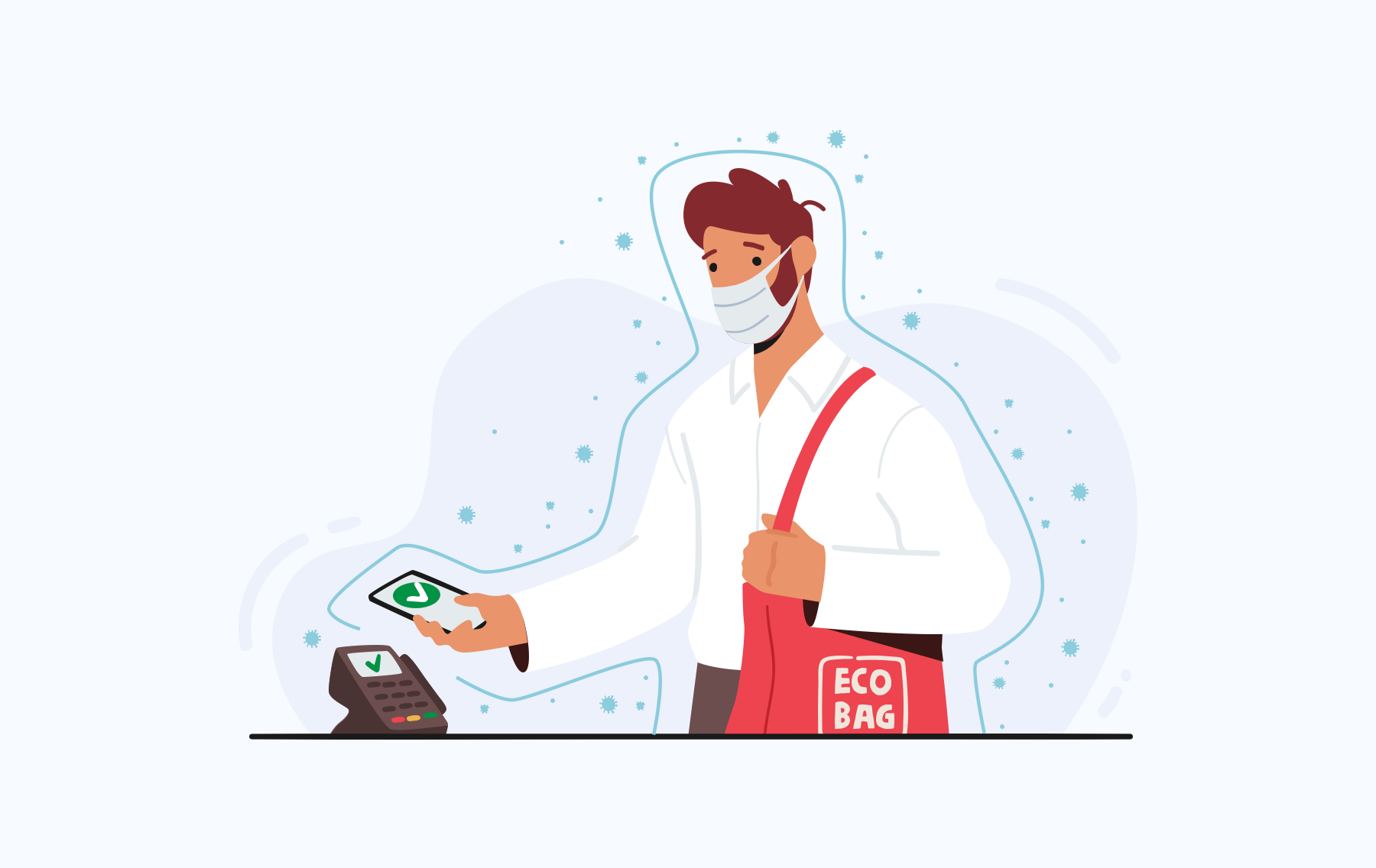

How to Pay Online During COVID-19 Pandemic

Inevitably, everybody still had to survive, from individuals to mega corporations, and that cycle that circulated payments around had to go on, but no longer in the form that it had been for decades now. The electronic facet of payments industry saw adoption – well, maybe an “embrace” could deliver the meaning better – like no other, even from the aged population who are generally very hesitant to do things they cannot confirm with at least three of their senses. The unimaginable effects of the coronavirus pandemic fueled not only the nightmares of the future of mankind but also e-commerce that saw a 30% rise in 2020 compared to the previous year. And that figure seemed only attainable by no earlier than 2022 previously. Baby boomer generation – who are considered to be between 50 to 70 ages now, have used online payment applications at a rate of 58 percent.

New Types of Payment Methods

Payments in the future were definitely predicted to be in all forms of electronic variety – many e-wallet options, emergence of a bank-less payments industry, a deluge of mobile payments all pointed in the same direction: The future of payments lied with less contact and less tangible products. What wrong was the time frame such a future would be “today”. And, well, if a crazed scientist did not contemplate Covid 19, nobody but her/him could predict such short notice.

Two years into the pandemic and we do not have a specific cure for the disease and even the most successful vaccines do not provide 100% cover from its blight which, as a whole, simply means minimizing risks take top priority. Instead of exchanging banknotes or coins, or tapping point-of-sale card reader’s numpad, hovering the card above the card reader became the norm, no matter what the scale or type of business. The true heirs to the future of payments, the payments industry that is involved in providing APIs for businesses’ online shops took flight already, streamlining the whole process and of course minimizing the risks both pandemic and security-wise.

The payments in the future will most likely include, maybe, cybernetics, like the lot called “bio-hackers” do through inserting chips subdermal even today – however if that looks too cyberpunk to you, check your contactless credit cards, cryptocurrency loaded e-wallets and online payments you do via your mobile apps because that future is “now”.

Create a Jeton account today and live the privileges of being on a platform providing custom-made solutions to fulfill your needs and expectations!